UK Health and Medical Insurance Market Size & Trends | Mordor Intelligence

Mordor Intelligence has published a new report on the “UK Health and Medical Insurance Market” offering a comprehensive analysis of trends, growth drivers, and future projections

Introduction

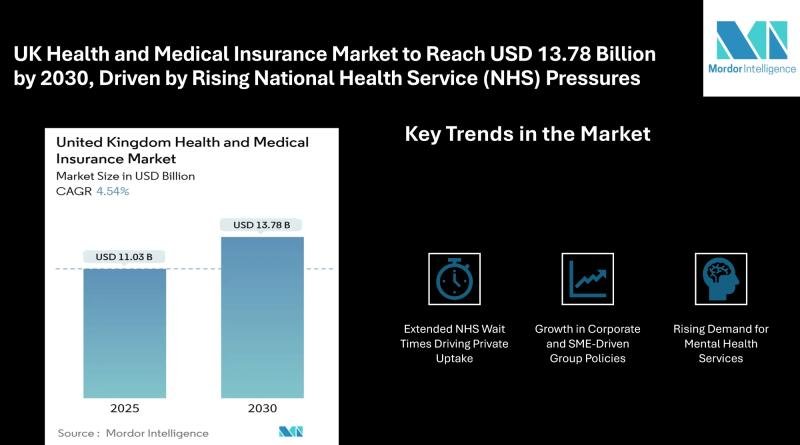

The United Kingdom health and medical insurance market, valued at USD 11.03 billion in 2025, is projected to grow steadily to USD 13.78 billion by 2030, at a CAGR of 4.54%. This upward trajectory reflects increasing consumer reliance on private health insurance, driven by mounting pressures on the National Health Service (NHS), extended waiting times, and a growing preference for personalized and timely healthcare.

Health insurance in the UK, traditionally seen as a supplementary product to NHS services, is witnessing renewed relevance amid rising demand for faster medical access. Consumers and employers alike are prioritizing private cover as part of broader well-being strategies. In parallel, health insurers are tailoring products that cater to evolving customer expectations for flexibility, digital integration, and mental health support.

Report Overview: https://www.mordorintelligence.com/industry-reports/united-kingdom-health-and-medical-insurance-market?utm_source=openpr

Key Trends

Extended NHS Wait Times Driving Private Uptake

Lengthening waitlists for elective treatments and specialist appointments under the NHS have encouraged a shift toward private healthcare coverage. Consumers increasingly seek alternatives that allow faster access to diagnostics, surgeries, and consultations. This trend is further supported by media coverage and public discourse around healthcare accessibility.

Growth in Corporate and SME-Driven Group Policies

There is a notable rise in group health insurance policies, especially among small and medium-sized enterprises (SMEs). Employers are viewing health benefits as essential tools to retain talent, reduce absenteeism, and support workforce well-being. Flexible group policies with tiered coverage are being adopted across a wide range of industries.

Rising Demand for Mental Health Services

Insurers are expanding mental health coverage in response to heightened public awareness and demand. More policies now include access to counselling services, digital therapy, and psychiatric consultations. This has become a core value proposition, particularly in comprehensive and employee-focused plans.

Digital Platforms and Telehealth Integration

Digital health features are now common across many health insurance products. Teleconsultations, app-based symptom checkers, and digital claims processing are being prioritized by providers. Consumers appreciate convenience, while insurers benefit from operational efficiencies and improved user engagement.

Shift Toward Modular and Customizable Policies

Insurers are moving away from one-size-fits-all plans. Customizable health insurance modules, where consumers select cover types, co-payment options, and additional services, are gaining ground. This flexibility is appealing to younger demographics and tech-savvy users looking for tailored coverage.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/united-kingdom-health-and-medical-insurance-market?utm_source=openpr

Market Segmentation

The UK health and medical insurance market is segmented across multiple parameters, reflecting diverse customer needs and product offerings:

By Policy Type

Individual Policies

Group/Corporate Policies

By Coverage Type

In-Patient Only

Comprehensive

Others (including Outpatient and Mental Health Add-Ons)

By Distribution Channel

Independent Financial Advisers (IFAs)

Direct-To-Consumer

Bancassurance & Affinity Partnerships

Others (Including Online Aggregators)

By End User

Individuals & Families

Small and Medium Enterprises (SMEs)

Others (Including Large Corporates and Self-Employed)

By Region

England

Scotland

Wales

Northern Ireland

The market demonstrates strong urban uptake, particularly in London and Southeast England, where private healthcare alternatives are in greater demand and employer-sponsored plans are more common.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

The UK health and medical insurance market features a mix of domestic and multinational insurers offering diversified products through multiple channels.

Bupa

A leading player, Bupa offers a wide range of private medical insurance solutions for individuals and businesses. Known for its own healthcare facilities and digital health services, Bupa has consistently invested in mental health and preventive care offerings.

AXA Health

AXA Health emphasizes employee benefits and personalized wellness programs, offering access to mental health practitioners, virtual GP services, and specialist care. Its corporate client base remains a major driver of growth.

Aviva

Aviva combines its extensive insurance portfolio with strong digital tools, offering integrated health cover with quick access to treatment and well-being support. Its MyAviva app is central to customer engagement, providing 24/7 health advice and policy management.

VitalityHealth

VitalityHealth differentiates itself with a rewards-based model that incentivizes healthy behaviors. Its policies often include fitness tracking, lifestyle discounts, and wellness coaching, appealing to younger policyholders and wellness-focused employers.

WPA (Western Provident Association)

WPA serves both individuals and businesses, offering flexible, modular plans. It is recognized for its customer-centric approach and transparent claims processes. WPA also caters to high-net-worth clients with premium product tiers.

Conclusion

The UK health and medical insurance market is undergoing a meaningful transformation as consumer expectations shift toward speed, choice, and digital engagement. With NHS wait times remaining a persistent concern, private health cover is being viewed not only as a luxury but as a necessary safeguard. Group policies are becoming a key feature of employer benefits packages, especially in a competitive labor market.

Insurers are adapting through customization, mental health integration, and digital access, all of which are helping to redefine private healthcare experiences in the UK. As the market continues to grow, providers that offer flexible, value-driven policies aligned with evolving customer needs are best positioned to thrive.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/united-kingdom-health-and-medical-insurance-market?utm_source=openpr

Industry Related Reports

United States Health And Medical Insurance Market: The US Health and Medical Insurance Market is Segmented by Coverage Type (Employer-Sponsored, Individual (ACA / Non-Group), and More), Plan Type (HMO, PPO, EPO, and More), Insurance Type (Major Medical (Comprehensive), Medicare Supplement, and More), Distribution Channel (Direct To Consumer, Brokers & Agents, and More), and Region (Northeast, Midwest, and More)

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-health-and-medical-insurance-market?utm_source=openpr

UAE Health And Medical Insurance Market: The UAE Health and Medical Insurance Market is Segmented by Insurance Type (Individual, Group), by Service Provider (Private Health Insurance Providers, Public/Social Health Insurance Schemes), by Distribution Channel (Direct Sales, Online Sales, Brokers/Agents, and Banks), by End-User/Customer Type (Corporate/Employer, Individual/Families, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-health-and-medical-insurance-market?utm_source=openpr

Indonesia Health And Medical Insurance Market: The Indonesia Health and Medical Insurance Market is Segmented by Product Type (Individual Health Insurance, Group Health Insurance), Provider (Public/Social Health Insurance, Private Health Insurance), Distribution Channel (Agents, Brokers, Banks, Online, and More), Term of Coverage (Short Term, Long Term), and Region (Western, Eastern, Central).

Get more insights: https://www.mordorintelligence.com/industry-reports/indonesia-health-and-medical-insurance-market?utm_source=openpr

Germany Health And Medical Insurance Market: The Germany Health and Medical Insurance Market is Segmented by Product Type (Statutory Health and Private Health Insurance), Term of Coverage (Short-Term and Long-Term), Distribution Channel (Single-Tied, Direct Selling, Credit Institutions, and More), End-User (Corporate/Employer, Individual/Families, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/germany-health-and-medical-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.